If you’re reading this, you’re probably aware that a duopoly of two little companies named Google and Facebook currently control the bulk of North American digital advertising. The dynamic duo’s share of all digital ad revenue in the US has grown to almost ⅔, while in Canada it is closer to ¾. As humans, we struggle to comprehend and manage the economic, social and psychological impact of this dominance over our attention. But as advertisers, we just love marketing on Facebook and Google. There are a few reasons why: superior audience targeting; performance trackability; optimization tools, and unimaginable reach. They are data-driven platforms and marketers need data on their customers in order to spend advertising dollars efficiently. So it makes sense that, if total advertising revenue were a pizza, Facebook and Google eat first, while everyone else is lucky to get to the box for a thin slice and some leftover crusts.

It’s no wonder we keep seeing all these layoffs at media companies and publishers. There are simply not enough ad dollars to go around. Good journalism and the publicization of that content is expensive — and is funded mostly by advertising. Publishers are forced to carve up a smaller and smaller slice of the pie that pays for their content, even while overall digital ad spending continues to rise. Meanwhile, Facebook is the world’s most popular media platform, yet they create virtually no media of their own.

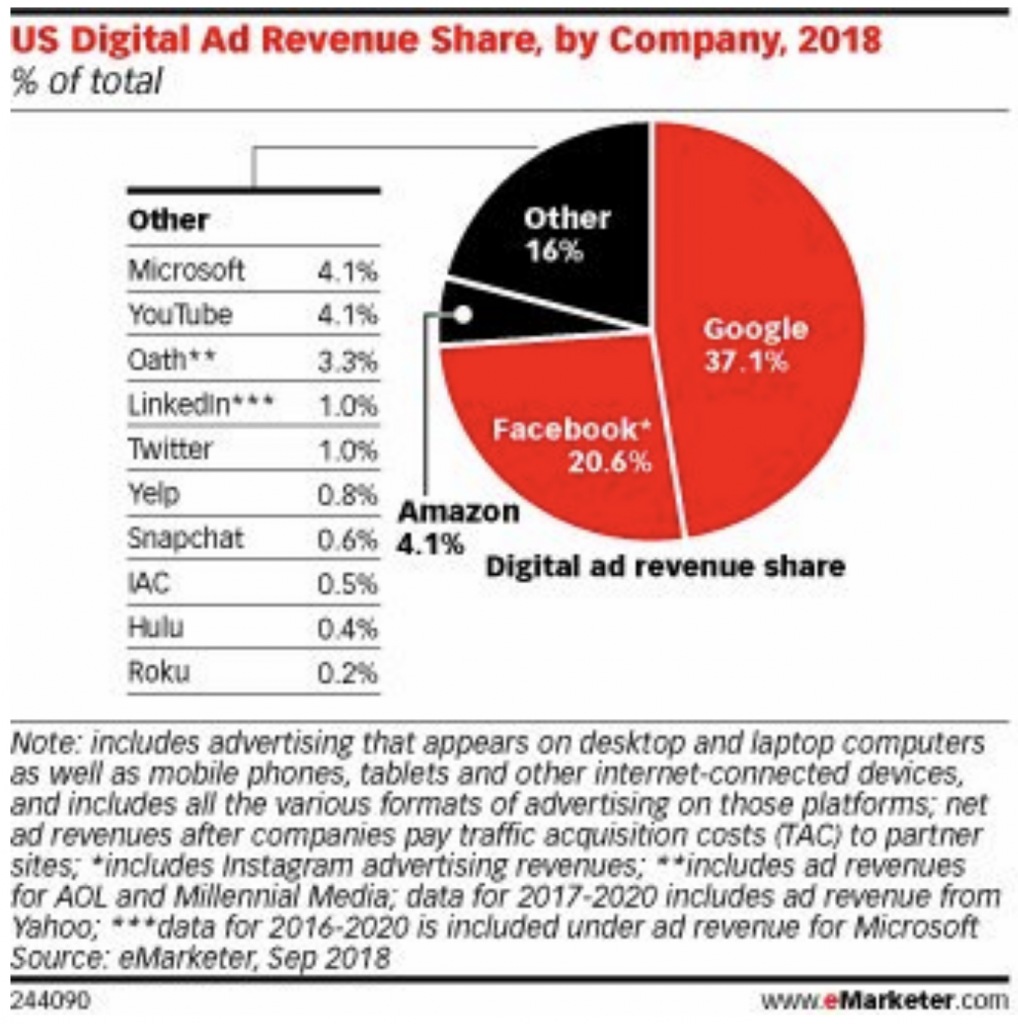

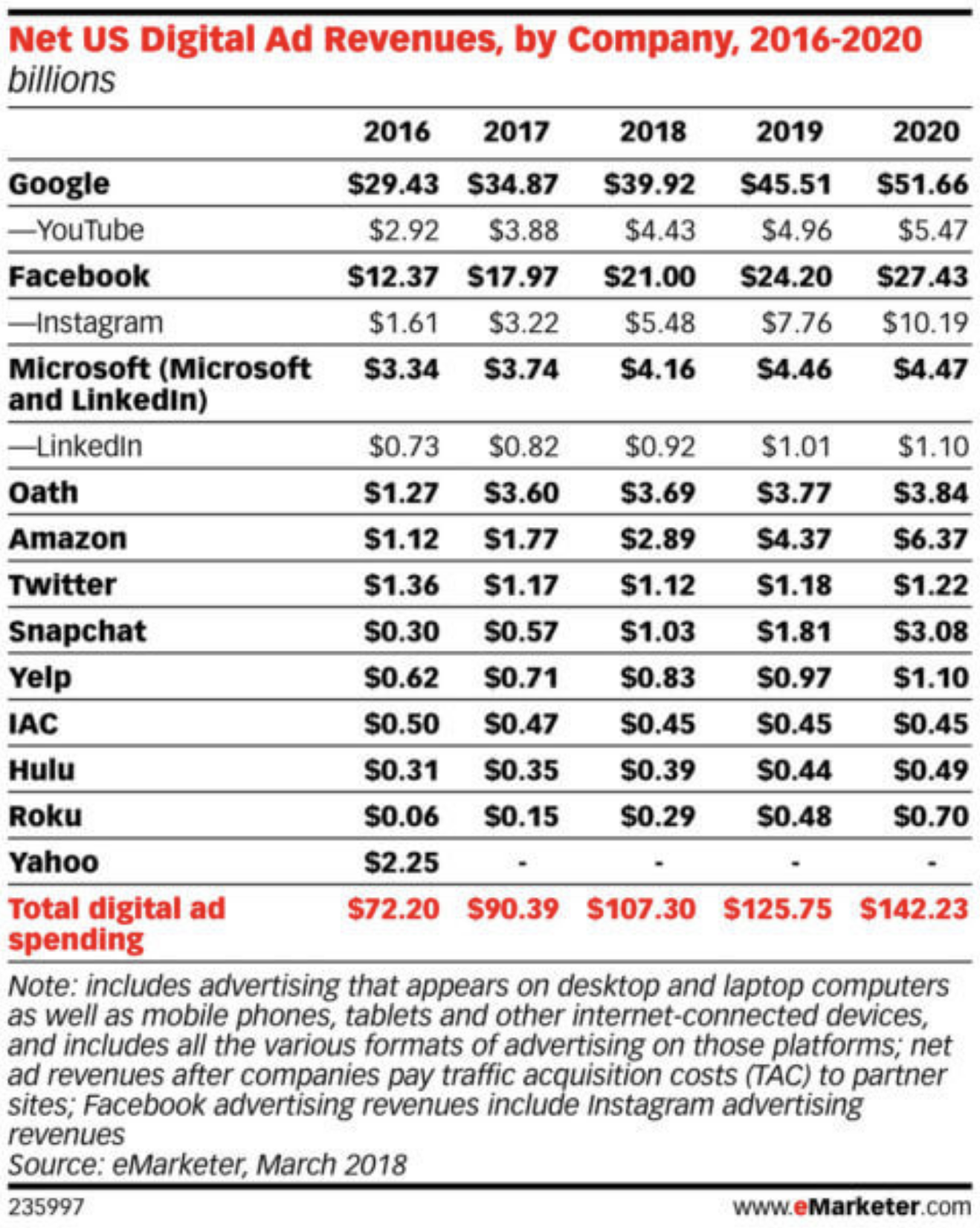

Look at these charts and now consider that the figure for Google above does not include YouTube (the lion’s share of “Other”). Also, note that LinkedIn, Twitter, Yelp and Snapchat combined only captured 3.4% of US digital ad revenues in 2018.

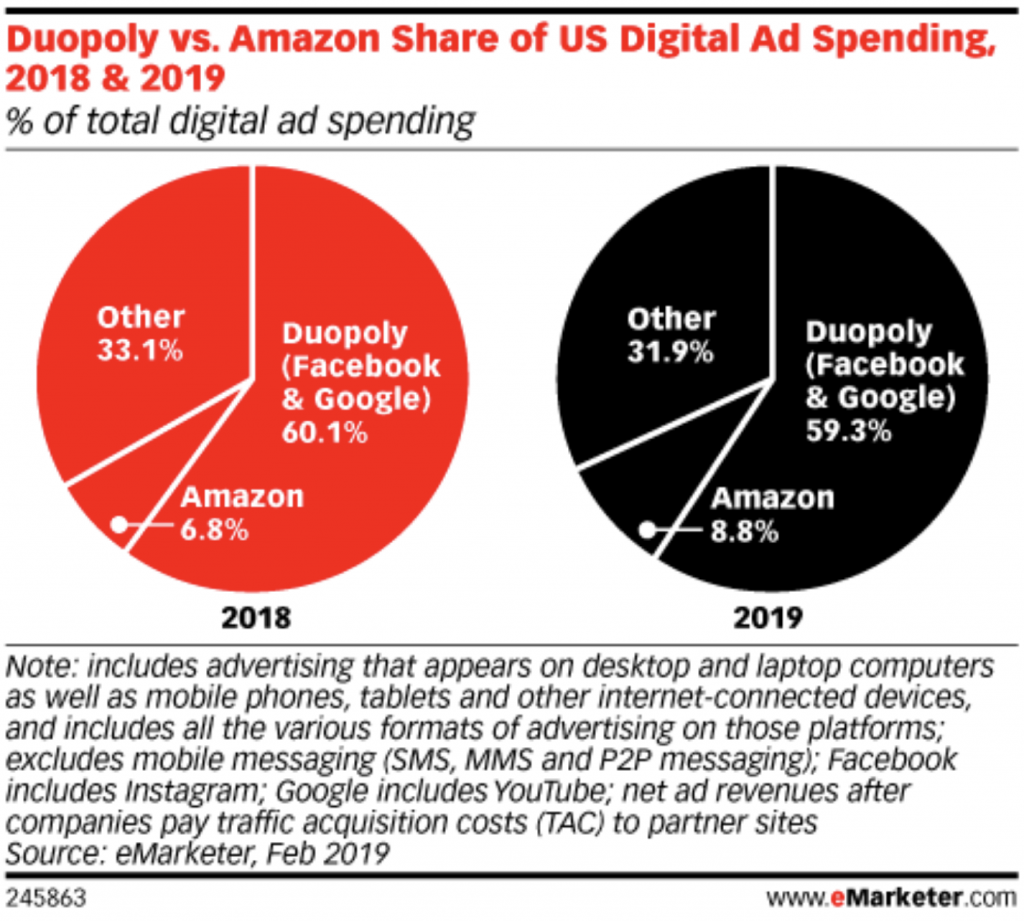

However, a small shift is underway. In 2019, the US ad market will hit two major milestones:

- For the first time, advertisers will spend more on digital media than on traditional media

- For the first time, Google and Facebook’s share of digital ad spending will decline

Enter Amazon

Amazon has finally taken a seat at our $130B pizza party, and they are hungry. So much so, that eMarketer recently updated their ad revenue forecast for 2018 and 2019:

According to emarketer, Amazon is expected to net 8.8% of US digital ad spending this year, up from 6.8% in 2018. Compare that increase to Facebook and Google’s. Advertising is one of Amazon’s fastest-growing divisions, with a reported 95% year-over-year Q4 increase in revenue in its “other” category, which primarily includes ad sales. For comparison, Amazon’s online store sales grew 14%, and Amazon Web Services sales rose 46% year-over-year for the same period (Q4 2018).

What’s behind this push into advertising services? Considering their platform and reach, it makes business sense that Amazon would shift investment from their mature retail and e-commerce business to higher margin products like digital services and advertising. People visit Amazon to do one thing: shop products. As an advertiser trying to sell products, that’s the place to be. The inherent value of Google’s Ads platform for marketers is that it enables you to put your product in front of someone who is actively in the process of searching for it. Amazon is now in a similar position, and it stands to benefit immensely from layering on all the data it has about users’ purchase habits. It’s also now replacing Google as the go-to destination for product searches.

When you consider the host of improvements to the ad platform’s tools and user experience, Amazon is poised to become a digital advertising juggernaut.

As a digital agency with a specialty in consumer products like toys and games, we’ve seen these changes drive ROI dramatically within Amazon, and have ourselves been allocating more of our clients’ media budget into Amazon. The results have ranged from good to great, with Amazon consistently delivering better ROAS than other digital platforms. Granted, the disappearance of once formidable retailers like Toys R Us, Sears, and other brick and mortar chain stores is responsible for this trend in part.

As Amazon continues to grow market share, it will be interesting to see how much of the pie will come from true media publishers, and how much share the Duopoly will concede. It’s likely Google and Facebook will respond by acquiring more high-attention and highly addictive properties, while journalism, content creators and publishers will continue to suffer… or be swallowed up.